TL;DR (Brief article summary):

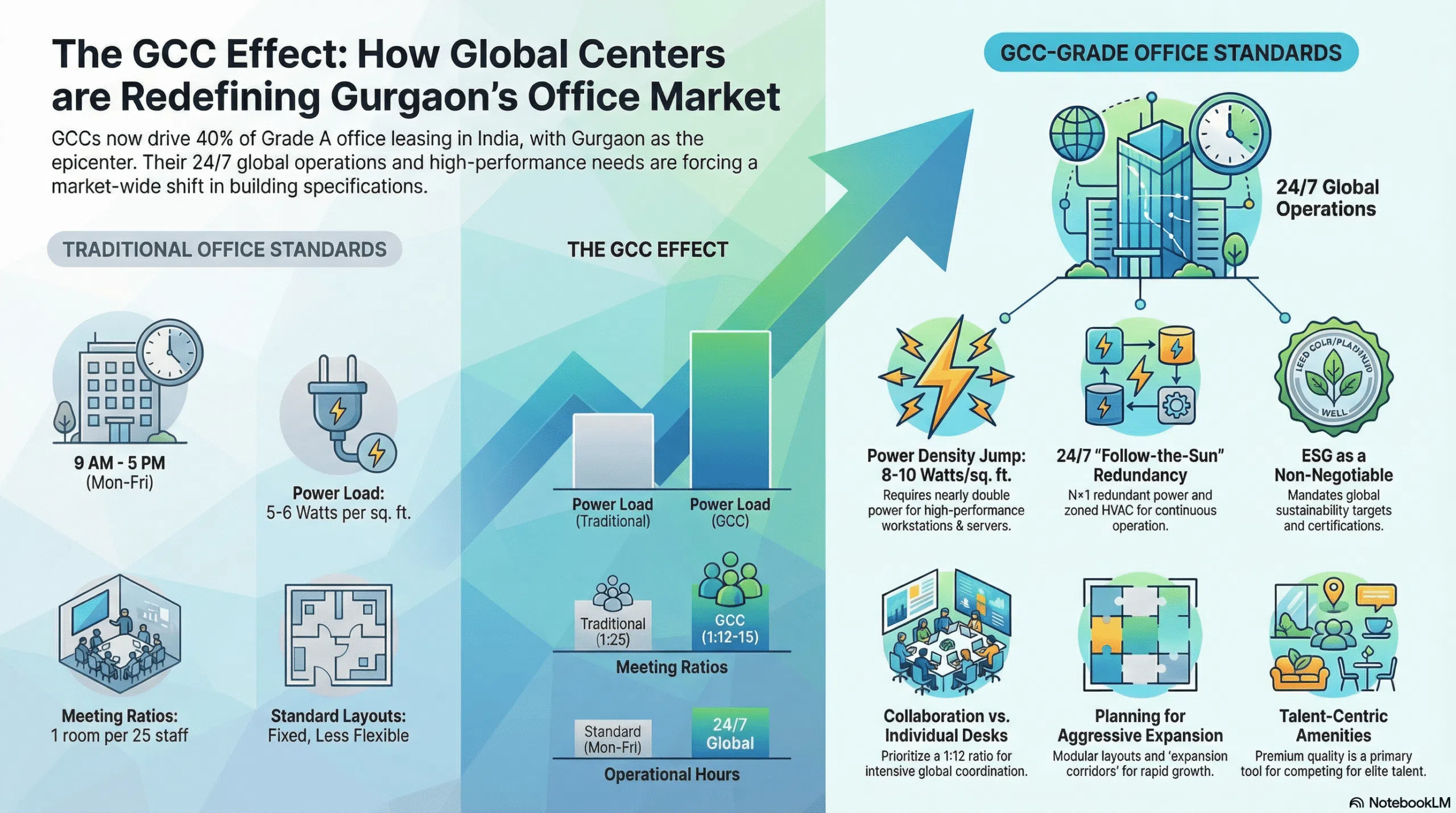

GCCs drive 40% of India’s Grade A office leasing and reshape what “quality space” means. Unlike traditional tenants, they need 24/7 infrastructure, higher power loads, intensive collaboration zones, and expansion capacity. Companies competing for the same buildings must either meet similar specs or find different micro-markets entirely.

Global Capability Centers didn’t just arrive in Gurgaon. They reshaped it.

India now hosts 1,800+ GCCs employing nearly 2 million professionals. By 2030, that number hits 2,100-2,400 centers contributing over $110 billion annually. And Gurgaon is North India’s GCC epicenter—home to Google’s massive expansion, Nagarro’s seven-figure square footage commitment, and dozens of enterprise-scale operations running global product engineering, AI development, and 24/7 customer operations.

Here’s what most companies miss: GCCs aren’t just taking up office space. They’re changing what office space needs to be.

When 40% of Grade A leasing comes from GCCs with specific infrastructure requirements, developers design buildings to meet those needs. Which means if you’re evaluating the same buildings, you’re competing against specs designed for operations that look nothing like yours—or you need to understand what GCCs require and how that affects your options.

What Makes GCC Office Requirements Different

Traditional office tenants show up Monday through Friday, run standard business hours, need basic power and connectivity, and plan space for current headcount plus modest growth.

GCCs operate completely differently.

They run 24/7 global operations. When you’re supporting teams in California, London, and Singapore simultaneously, your office never really closes. That changes everything about infrastructure. Power needs to be redundant. HVAC runs around the clock. Security operates in shifts. Maintenance windows shrink because there’s no “after hours.”

They need higher power density. Traditional offices run on 5-6 watts per square foot. Tech-heavy GCCs need 8-10 watts, sometimes more. They’re running high-performance workstations, development servers, testing equipment, video walls for global collaboration. If the building wasn’t designed for this load, you can’t just plug in more equipment—the infrastructure literally can’t handle it.

They plan for aggressive expansion. A GCC that leases 30,000 square feet today expects to occupy 50,000 within 24 months. That’s not unusual—it’s the model. Global companies establish Indian operations precisely because they can scale talent fast. So GCCs need buildings designed with expansion capacity: additional floors available, infrastructure oversized for day-one needs, layouts that accommodate phased growth without complete reconfiguration.

They prioritize collaboration intensity over individual workstations. Because GCCs coordinate across time zones and run complex product development, they’re meeting-heavy. Video conference rooms with high-quality AV. Collaborative zones for design reviews. Training spaces for onboarding waves of new hires. That shifts the space ratio dramatically—less square footage per desk, more square footage for shared collaboration.

They care about brand perception and talent competition. GCCs compete globally for engineers, product managers, data scientists. The office isn’t just functional space—it’s a talent recruitment and retention tool. That means Grade A+ buildings in premium micro-markets. ESG certifications because parent companies have sustainability mandates. Amenities that signal you’re operating at enterprise scale.

They require compliance-ready infrastructure. Many GCCs handle sensitive data, proprietary product development, or regulated operations. That means specific security protocols, network segmentation, access controls, backup systems. The building needs to support compliance requirements, not fight them.

These aren’t minor differences. They’re fundamental operational requirements that change how you evaluate and design office space.

How GCC Demand Is Changing Gurgaon’s Building Inventory

When developers know 40% of potential tenants have GCC-level requirements, they build differently.

Power infrastructure gets oversized. New Grade A buildings in Gurgaon now spec 8-10 watts per square foot as standard, not 5-6. They’re installing larger electrical panels, more robust backup generators, redundant power feeds. This costs more upfront but makes buildings GCC-ready—and commands premium rents.

Floor plates favor collaboration over density. You’re seeing wider column spans (40-50 feet instead of 30-35), which allows flexible layouts without structural interruptions. Higher floor-to-ceiling heights (12+ feet instead of 10) to accommodate complex HVAC and cable management. These design choices support the collaboration-heavy layouts GCCs prefer.

HVAC systems run 24/7-capable. Buildings are installing zoned climate control that can cool specific areas overnight without running the entire floor. More efficient systems that handle extended runtime without maintenance issues. Backup cooling for critical areas. This isn’t typical in traditional office buildings—it’s GCC-driven demand.

Meeting room ratios shift. Where standard buildings might plan one conference room per 25 employees, GCC-oriented developments are going 1:12 or 1:15. They’re building in AV infrastructure, soundproofing, recording capability. The meeting rooms aren’t afterthoughts—they’re core to the space program.

ESG certifications become standard, not premium. GCCs need LEED Gold or Platinum, GRIHA ratings, WELL Building certification because their parent companies have ESG targets. Developers pursuing GCC tenants build to these standards from day one. That’s raising the baseline for what “Grade A” means in Gurgaon.

Expansion corridors get planned into building design. Instead of leasing out every floor immediately, developers hold back adjacent space for tenant expansion. Or they design interiors to be modular—easy to reconfigure as teams grow. This flexibility carries a cost (lost rental income on held space), but it matches how GCCs actually operate.

For companies evaluating office space in Gurgaon, this shift creates both opportunities and challenges. If your operational needs align with GCC specs, you benefit from better infrastructure. If they don’t, you might be paying for capacity you’ll never use—or competing for buildings designed around requirements that don’t match yours.

The Infrastructure Specs GCCs Actually Demand

Let’s get specific about what GCC-grade infrastructure means.

Electrical capacity and redundancy:

8-10 watts per square foot minimum, often 12+ for development centers

N+1 redundant power (backup generators that can handle full load plus buffer)

UPS systems rated for 30+ minutes to bridge generator startup

Separate power feeds from different grid sources where possible

Dedicated circuits for server rooms, network closets, critical equipment

Standard office buildings might have one generator that handles 60-70% of building load. GCCs need generators that can run the entire operation indefinitely. That’s a massive infrastructure difference.

Network and connectivity:

Dual ISP connections from different providers (redundancy)

Fiber backbone throughout building, not just to floors

Network closets every 5,000-7,500 square feet

Structured cabling pathways designed for high-density data

Isolated networks for development, production, corporate functions

Bandwidth capacity for video-heavy collaboration (hundreds of concurrent calls)

HVAC and climate control:

24/7 operation capability without maintenance penalties

Zoning that allows cooling specific areas independently

Precision cooling for server rooms (68-72°F constant, not 74-76°F office standard)

Humidity control (critical for equipment reliability)

Air filtration rated for tech equipment (preventing dust accumulation)

Physical security and access control:

Biometric or card-based access with granular permissions

Separate secure zones for sensitive development work

CCTV coverage meeting compliance requirements

After-hours access protocols that don’t compromise security

Visitor management that integrates with compliance logging

Layout flexibility and expansion planning:

Raised flooring for cable management (easier to reconfigure)

Modular workstation systems (add/remove desks without electrical work)

Pre-wired expansion zones (infrastructure ready, furniture added as needed)

Meeting rooms designed for AV upgrades (conduit, power, mounting infrastructure)

Companies evaluating managed office space in Gurgaon often find GCC-grade infrastructure already in place. Managed providers targeting enterprise clients build these specifications upfront because they’re serving multiple companies with similar requirements.

What This Means for Companies Competing for the Same Buildings

If you’re evaluating office space in Gurgaon’s prime micro-markets—Cyber City, Udyog Vihar, Golf Course Extension—you’re competing with GCCs for inventory.

That creates specific dynamics worth understanding.

Rents reflect GCC-grade infrastructure. Buildings in Sector 32 or premium Udyog Vihar properties command ₹100-140 per square foot partly because they meet GCC specifications. If you don’t need 24/7 power redundancy or 8 watts per square foot, you’re paying for capacity you won’t use. That’s not necessarily bad—the infrastructure makes the building more reliable overall—but it affects ROI calculations.

Vacancy compression favors GCC-ready buildings. With GCCs driving 40% of Grade A leasing and vacancy in prime micro-markets dropping to 13-14%, buildings with GCC-capable infrastructure lease faster and maintain higher occupancy. If you need space quickly, you’ll find more options in GCC-grade buildings simply because that’s what’s getting built.

Expansion flexibility becomes harder to negotiate. When GCCs routinely request expansion rights in their leases, landlords hold back adjacent space or charge premiums for expansion options. If you’re a 100-person company that might grow to 140, getting expansion rights in a building where three GCC tenants also want to expand gets complicated. You might need to commit to larger initial space or accept less favorable terms.

Customization costs shift. GCC-grade buildings have robust base infrastructure, but less flexibility for unique customization. The power, HVAC, and network infrastructure is designed for specific use patterns. If you want something unusual—test kitchens, manufacturing labs, specialized equipment—you might face higher fit-out costs because you’re working around standardized GCC specs.

Alternative strategies emerge. Some companies are choosing different paths rather than competing with GCCs for premium inventory:

They target emerging micro-markets like Dwarka Expressway or Sohna Road where GCC density is lower and buildings are designed for broader tenant profiles. They accept slightly longer commutes or less prestigious addresses in exchange for better economics and more negotiating leverage.

They use managed office models that aggregate space across multiple buildings, giving them flexibility without committing to GCC-scale infrastructure they don’t need. A 75-person team doesn’t need dedicated generators and 24/7 HVAC—managed providers pool that infrastructure across tenants.

They focus on buildings with mixed tenant profiles rather than GCC-heavy properties. Some developments intentionally lease to consulting firms, regional offices, mid-market companies alongside GCCs. That creates more diverse lease terms and less competition for identical specifications.

GCC Growth Patterns and What They Signal for the Market

Understanding where GCCs are expanding helps predict where infrastructure investment will concentrate.

Gurgaon’s GCC growth is accelerating, not plateauing. NCR (primarily Gurgaon) accounts for roughly 13% of India’s GCC base, trailing Bengaluru and Hyderabad. But Gurgaon offers advantages for certain GCC types: proximity to Delhi for government relations, international airport access for frequent travel to headquarters, established corporate ecosystem in finance and consulting.

Finance and consulting GCCs cluster here more than pure tech GCCs, which prefer Bengaluru. That shapes the type of office space in demand—less hardcore engineering infrastructure, more client-facing presentation capability and regulatory compliance infrastructure.

The 24/7 operations model is spreading beyond GCCs. Companies watching GCCs operate successfully with follow-the-sun support models are adopting similar patterns. Customer success teams, DevOps, security operations—lots of functions now run extended hours even if they’re not technically GCCs. That increases demand for infrastructure GCCs pioneered.

Hybrid work hasn’t reduced GCC space needs—it shifted them. GCCs are using less space per employee (going from 120-150 sq ft per person to 80-100 sq ft) but leasing more total space because headcount growth exceeds density reduction. And they’re prioritizing collaborative space over workstations, matching the hybrid pattern where people come to office for meetings and teamwork.

Expansion velocity is the biggest planning challenge. A GCC that starts with 200 people and grows to 500 within 18 months creates intense space pressure. Traditional lease models don’t accommodate this well—you either over-commit space upfront (expensive if growth doesn’t materialize) or face relocation costs when you outgrow the space faster than expected.

This is where flexible space models and build-to-suit approaches intersect. Some GCCs use managed offices initially, then transition to dedicated build-to-suit space once they hit scale. Others maintain hub-and-spoke models with a large anchor location plus satellite spaces for overflow teams.

How to Evaluate Space If You’re Not a GCC (But Need to Compete)

If you’re planning office space in a GCC-heavy market, here’s what actually matters:

Map your actual infrastructure needs against GCC specs. Don’t assume you need everything a GCC would require. Run through your operations honestly:

Do you need 24/7 power redundancy, or would 99% uptime during business hours work fine? Are you running equipment that requires 8+ watts per square foot, or is standard 5-6 watts adequate? Will you double headcount in 18 months, or grow steadily at 15-20% annually? Do you need meeting rooms at 1:12 ratio, or would 1:20 work given your collaboration patterns?

The more your requirements align with GCC specs, the more you benefit from GCC-driven infrastructure investment. The more they diverge, the more you should look at buildings designed for different tenant profiles.

Calculate the premium you’re paying for unused capacity. GCC-grade buildings cost more. Some of that premium delivers value even if you’re not a GCC—better reliability, stronger infrastructure, higher-quality materials. Some you’ll never use—overnight HVAC capacity, triple-redundant power you don’t need, expansion zones you won’t fill.

Run the math on whether ₹100/sq ft in a GCC-grade building delivers better value than ₹75/sq ft in a standard building that meets your actual needs. Factor in your total cost of occupation—not just rent, but operational costs, productivity, retention.

Consider timing and lease flexibility. GCCs often sign 6-9 year leases because they’re making infrastructure investments and planning long-term operations. If you’re less certain about 5-year plans, paying a premium for GCC-grade infrastructure in a building where everyone else has locked in long commitments might limit your flexibility.

Managed office models often make more sense in this scenario—you get GCC-grade infrastructure without long-term commitment, at a cost premium that might be worth it for the flexibility.

Think about talent competition, not just building competition. If you’re recruiting the same profiles GCCs hire—engineers, product managers, data analysts—you’re competing on office quality whether you want to or not. A 27-year-old engineer comparing your offer to a GCC offer will notice if your office is in a C-grade building while the GCC is in premium space.

Location matters more than building grade for some roles, amenities matter more for others, commute matters most for parents. But office quality is part of the talent value proposition, especially in markets where GCCs set expectations.

Evaluate alternatives before committing to GCC-dominated inventory. Gurgaon has micro-markets where GCC density is lower and you have more leverage. Dwarka Expressway, Sohna Road, parts of New Gurgaon—these areas offer newer infrastructure without the premium positioning and competition of Cyber City or Golf Course Extension.

You might trade some prestige for better economics, shorter commutes for some employees, and more favorable lease terms. That trade makes sense for some businesses, not others. Just make it deliberately, not by default.

Conclusion: GCCs Are Raising the Bar—You Choose How to Respond

GCC growth in Gurgaon isn’t slowing down. India will add 400-600 more centers by 2030, with Gurgaon capturing a meaningful share. That means more GCC-grade buildings, higher infrastructure standards, and continued competition for premium inventory.

You have options for how to respond.

You can compete directly—target the same buildings, accept the premium rents, benefit from GCC-driven infrastructure quality. This works if your operational needs align reasonably well with GCC specs and you value the ecosystem GCC-heavy buildings create.

You can differentiate—choose micro-markets where GCC density is lower, target buildings with mixed tenant profiles, prioritize different value propositions like commute convenience or cost efficiency over infrastructure redundancy.

You can use flexible models—managed office space gives you GCC-grade infrastructure without long-term commitment, letting you scale up or down as your actual needs evolve rather than committing based on projections.

None of these paths is universally right. The best choice depends on your operational requirements, growth trajectory, talent strategy, and cost tolerance.

What matters is making the choice deliberately, with clear understanding of how GCC presence shapes your options and what trade-offs you’re actually accepting.

For guidance on evaluating office options in Gurgaon’s GCC-influenced market, get in touch with AIHP. For comprehensive analysis of infrastructure requirements and space planning frameworks, download The Ultimate Guide to Managed Office Spaces.

Frequently Asked Questions

GCCs typically use 80-100 square feet per employee versus traditional offices at 120-150 square feet, but this doesn't mean GCCs need less total space. The difference is in allocation—GCCs dedicate more square footage to collaboration zones, meeting rooms, and training spaces rather than individual workstations. They plan for 1 meeting room per 12-15 employees versus traditional 1:20-25 ratios. The density increase at individual desks gets offset by dramatically higher shared space requirements. For a 200-person GCC versus 200-person traditional office, total space might be similar (20,000-22,000 sq ft) but the layout and infrastructure demands differ completely.

Ask about watts per square foot capacity (8-10 watts minimum for GCC-grade, versus 5-6 for standard), generator backup capacity as percentage of building load (100%+ for GCCs, often 60-70% for standard), UPS rating in minutes (30+ minutes for critical systems), and whether power is redundant from separate grid sources. Request documentation on actual available capacity per floor, not just building total—some older buildings have adequate building-level power but insufficient distribution to individual floors. Verify generator maintenance history and runtime testing frequency. If the building regularly runs at 80%+ of electrical capacity, adding equipment-heavy operations becomes difficult regardless of what's theoretically available.

GCC-grade infrastructure is expanding beyond traditional premium zones. Dwarka Expressway, Golf Course Extension Road, and parts of Sohna Road now have buildings meeting GCC specifications, often at 15-25% lower rents than Cyber City. Developers recognized that not all GCCs need Cyber City prestige—back-office operations, engineering centers, and support functions prioritize infrastructure and cost over location brand. However, client-facing GCCs in consulting, finance, and enterprise software still cluster in established premium locations. The micro-market matters less for GCC viability than it did 3-5 years ago, which actually helps non-GCC companies find quality infrastructure in more cost-effective locations.

Managed office providers targeting enterprise clients often build GCC specifications as standard because they're aggregating demand across multiple tenants with similar needs. They install redundant power, 24/7 HVAC, high-density network infrastructure, and ESG certifications upfront rather than customizing for each tenant. This means smaller companies (50-150 employees) can access GCC-grade infrastructure without negotiating custom build-outs or signing 9-year leases. The trade-off is less control over specific customization and typically 20-30% premium on base rent versus traditional leases. However, when you factor in avoided CapEx, faster occupancy (60-90 days versus 5-7 months), and flexibility to scale, the economics often favor managed models for companies with GCC-like infrastructure needs but without GCC scale.

No, but it will create market segmentation. Gurgaon's office market is large enough and diverse enough to support multiple segments—premium GCC-focused buildings in Cyber City and Golf Course Extension, mid-tier buildings in Udyog Vihar and Sector 32 serving mixed tenant profiles, and value-oriented inventory in emerging corridors. As GCC density increases in premium zones, non-GCC companies will either pay the premium (if justified by talent competition or client perception) or target different micro-markets. What's changing is that "Grade A" increasingly means "GCC-capable," so companies wanting top-tier buildings need to either align with GCC specs or define quality differently. The market isn't becoming GCC-exclusive—it's becoming more stratified by infrastructure capability and tenant requirements.