When a 550,000 sq ft Lease Becomes a Market Earthquake

Gurgaon office market has seen its share of headline transactions in the past, but Google’s commitment to signing a 550,000 sq ft managed-workspace deal with Table Space brought the focus back on India’s “Millennium City” in one fell swoop. It’s the biggest managed-office deal in the nation this year and a new confidence booster in Gurugram’s ability to fuel global tech aspirations. The Economic Times quotes that the deal was sealed in 1st quarter of 2025 and has an option to expand by another 200,000 sq ft.

What does one mega-lease do to rental trends, investor sentiment, and the city’s economic life? Let’s deconstruct trend-by-trend.

Why Google Chose Gurgaon

Strategic Geography and Infrastructure

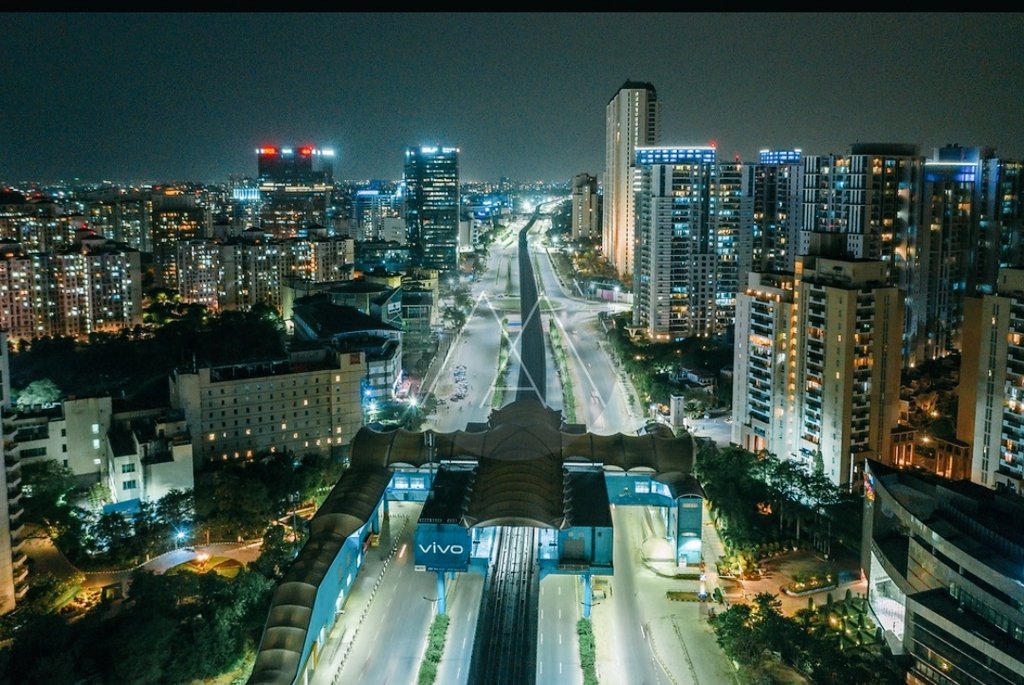

Situated on the Delhi–Mumbai industrial corridor and just 20 minutes away from India’s busiest airport, Gurgaon is a logistics check list in every way. Rapid-metro connectivity, eight-lane expressways, and Grade-A power and fibre networks render it a low-friction launch pad for global teams. Google’s real-estate team purportedly considered Bengaluru, Hyderabad, and Pune before settling on Gurugram for its “north-India talent hub and superior airport connectivity.”

Deep Talent Pool and Cost Advantage

NCR produces 100,000+ tech and MBA grads annually from IITs, IIMs, IIFT, and private universities. Pay levels are 15-20 % lower than similar jobs in Singapore, but the city performs well on English skills and digital-first attitudes—precisely the mix Google requires for engineering, ad-ops, and cloud-sales teams.

Deal Snapshot: What 5.5 Lakh Sq Ft Really Means

Key Numbers and Timeline

Metric | Figure |

Lease size | 550,000 sq ft (option +200 k sq ft) |

Location | Cyber City Extension, DLF Downtown |

Workspace provider | Table Space |

Tenure | 12 years with 3-year lock-in |

Fit-out hand-over | Q4 2025 |

Smartworks and WeWork each averaged 200,000 sq ft deals last year; Google just tripled that in one go.

Comparison With Google’s Other Indian Leases

- Bengaluru (2024): 500 k sq ft in Outer Ring Road tech park.

- Hyderabad (2023): 3 million sq ft owned campus (under development).

Gurgaon is Google’s largest leased (rather than owned) property in India, highlighting the attraction of asset-light growth via managed-office operators.

Immediate Ripple Effects on Commercial Real Estate

Vacancy Compression and Rental Uplift

CBRE figures positioned Gurugram’s Grade-A vacancy at 14 % pre-deal. Taking in half-a-million square feet all at once chopped nearly 90 basis points off that rate overnight. Brokers now predict a 7–10 % increase in prime-corridor rents by mid-2026 with space becoming tighter. Cyber City landlords are already adjusting quoting rates from ₹ 140 to ₹ 155 per sq ft per month.

Flight-to-Quality Among Multinationals

When a blue-chip tenant upgrades to next-gen managed space, peer companies rush to be anything but the weakest link in the amenities arms-race. Anticipate follow-up absorption by Google’s ecosystem—i.e., ad-tech partners, cloud integrators, and audit firms—within 12 months, pinching Grade-B landlords while valorizing premium towers.

Long-Term Impacts on Gurugram’s Office Sub-Markets

Cyber City & Golf Course Extension Road

These corridors already attract peak rents and have metro proximity. Google’s existence solidifies their status as NCR’s “tech moat,” prompting developers such as DLF and Brookfield to accelerate new towers and transit-oriented retail.

NH-8 & Udyog Vihar Corridors

Traditionally value-sensitive, these micro-markets will experience a knock-on boost. Smaller technology companies priced out of Cyber City may migrate west, eliminating historical void pockets and leveling the city’s absorption map.

What It Means to Institutional Investors

REIT Performance and Cap-Rate Outlook

India’s listed office-REITs—Embassy, Mindspace, Brookfield—have holdings in multiple assets in Gurugram. A massive tenant like Google de-risks short-term vacancy and warrants cap-rate compression of 20–30 bps, which drives NAVs higher and attracts yield hunters.

Development Pipeline Acceleration

Knight Frank’s Q1 2025 forecast highlighted 6.8 million sq ft under development in Gurgaon. Experts now anticipate another 1.5 million sq ft making it into planning by 2026 as developers compete for the “Google halo.”

Opportunities for Local Businesses and the Service Ecosystem

Co-Location Demand From Google’s Vendors

Ad-ops outsourcers, cybersecurity advisers, and F&B caterers prefer to be walkable from the anchor tenant. Micro-leases (20–40 k sq ft) in neighboring towers are expected, generating daytime traffic and establishing a self-sustaining cluster.

Boost to Retail, F&B, and Co-Living Sectors

Google’s average employee spends ₹ 700–1,000 a day on food, transportation, and evening leisure. Cafés in the vicinity of Cyber City, gyms, and co-living players must notice revenue surges, similar to the “Amazon effect” that has been seen in Seattle’s South Lake Union.

How Managed-Office Operators Will Respond

Table Space’s Role in the Mega-Deal

Table Space, which was a niche workspace-firm enterprise a few years ago, today boasts boasting rights as landlord to Google. Its portfolio spans 10.5 million sq ft across the country, and the company will use this marquee deal to attract other Fortune 500 clients.

Competitive Moves by Smartworks, WeWork, and AIHP

Competitors will not sit idle. Smartworks has just announced a 1-million sq ft expansion pipeline in NCR, and AIHP, which has premium managed offices in Gurgaon—is in talks of bulk pre-leasing with BFSI occupiers looking for “Google-grade” fit-outs with speed. Quick build-outs, wellness-focused amenities, and ESG-linked leases will be table stakes.

Action Checklist for Occupiers and Landlords

Stakeholder | To-Do in the Next 6 Months |

Corporate occupiers | Lock renewal clauses early; vacancy is tightening. Consider managed space for faster swing capacity. |

Landlords | Upgrade lobbies & ESG credentials to stay competitive; revisit rent benchmarks quarterly. |

Developers | Accelerate shovel-ready projects near metro or Dwarka Expressway; market “Google-adjacent” credentials. |

Investors | Monitor REIT yields; Gurugram cap-rate compression could lift valuations 10–15 %. |

Conclusion – Gurgaon Levels Up Again

Google’s 550,000 sq ft deal is not only a real-estate news item—it’s a multi-year driver. Vacancy compresses, rents rise, investors double-up, and Gurgaon solidifies its tech-capital reputation north of the Vindhyas. Companies that plan ahead—through traditional leases or flexible managed-office formats—are poised to surf the wave rather than pursue it.

Having your own Gurgaon footprint in mind? Schedule a tour of AIHP’s managed offices and observe how Fortune-500 standards converge with lightning-fast hand-overs, without the CapEx pain.

Frequently Asked Questions (FAQs)

It’s the city’s largest managed workspace deal and among India’s top five single-tenant leases to date.

The sharpest spikes will be in Cyber City and Golf Course Extension, but ripple effects will raise Grade-A asking rents city-wide.

Typically within 6–12 months. Google’s construction and move-in phases generate immediate demand for co-located support firms.

No, but managed offices now dominate large deals where speed, flexibility, and fit-out quality top the checklist.

Lease in adjacent towers while rates are still moderate, or partner with managed-office providers like AIHP for plug-and-play suites that share the “Google halo” without the price tag.